Take Initiative 2017

Role: UX Designer, Research, Wireframing, Prototyping, UI Design

Take Initiative is a two-day, global competition that takes place on the same days across 20 Mastercard offices. It is an opportunity for employees all around the globe to form teams and come up with and bring to life the next big thing for Mastercard. Christine Chu, Jamie Shin, Andrew Lee, and myself formed a team in the New York City office to create a solution solving for Mastercard's fight against cash and efforts in financial inclusion with the underbanked population. Our team won the local competition in NYC and placed in the top 5 teams overall.

Who, Where, Why:

Sanjay is an example of one of the 2 billion underbanked people in the world. He works hard to support his family and is constantly cutting down his expenses in order to save. He is the ideal candidate for our product, Mobile Trust.

The Problem:

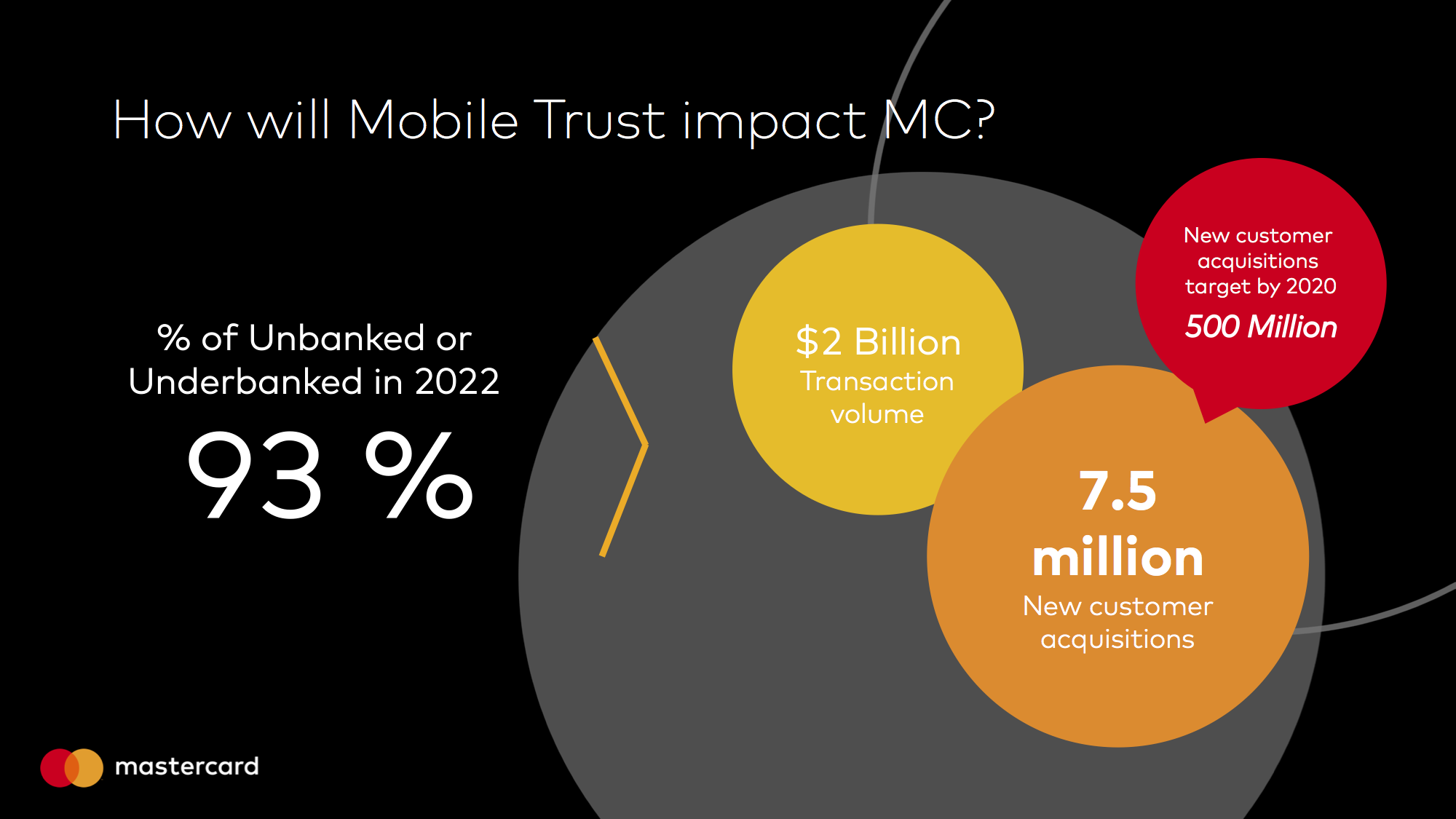

What we are trying to solve is getting the 2 billion people without bank accounts or credit scores to move to the financial system. The opportunity here is to bridge a gap between the 2 billion people and the lenders such as non profit organizations who are major players in the financial inclusion space.

The Solution:

We can help create a credit identity for users that are part of the underbanked population with a new scoring method that helps users become trusted by financial institutions while educating them about finances, ultimately getting consumers to onboard onto the banking system.

How?

A credit score is created depending on various factors such as transaction data, bill payments, and credit history, however there are various other factors unknown to the user that institutions use to generate the scores, making them official credit reports that are required by institutions. The key element that the underbanked population is missing is credit history, having never had a record of spending through financial institutions. Unfortunately a prepaid debit card does not contribute to a credit score at all, but as long as a user is using a Mastercard prepaid data, we can still track the user's frequency of use, transaction patterns, account history, and mobile prepaid data. This data can allow us to analyze the user and generate a "trust score" for them to have to assist them in applying for loans and opening bank accounts,

Design Solution:

India, along with many other countries with a great underbanked population, does not have the advanced technological infrastructure that many first world countries have. We developed interfaces for feature phones, smart phones, and desktop views so that the product is not exclusive to high end devices that may not be abundant in these countries.

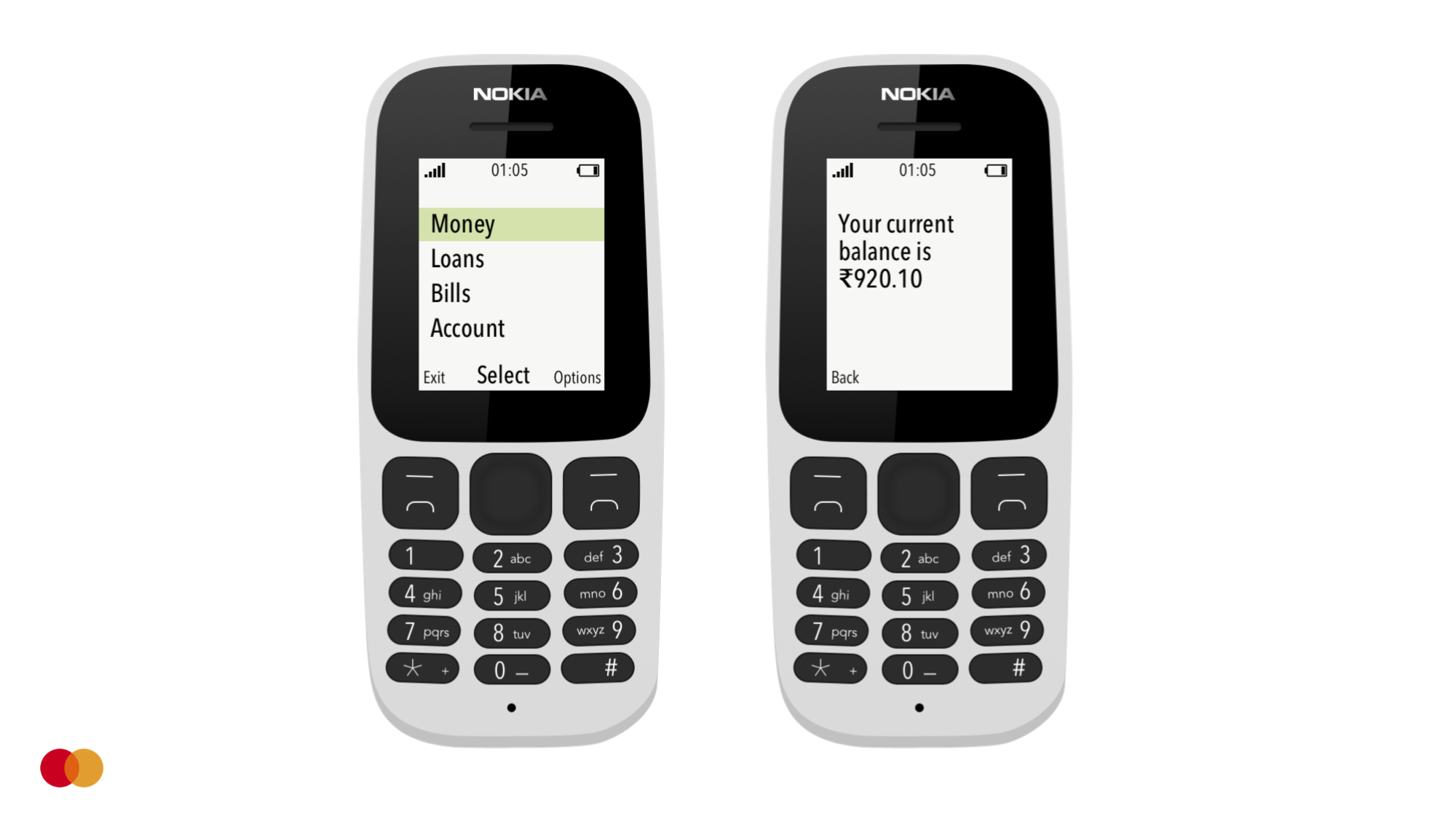

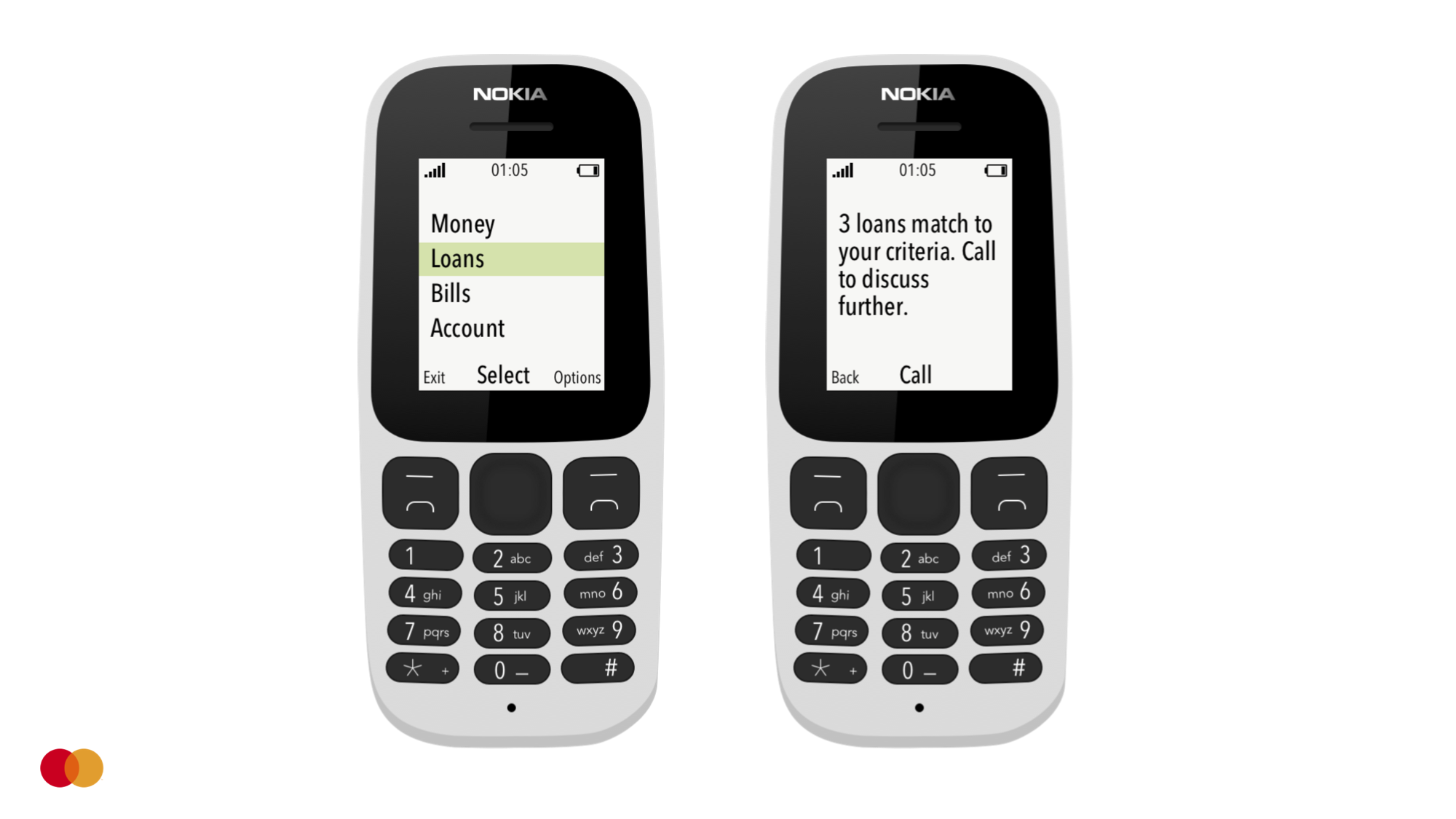

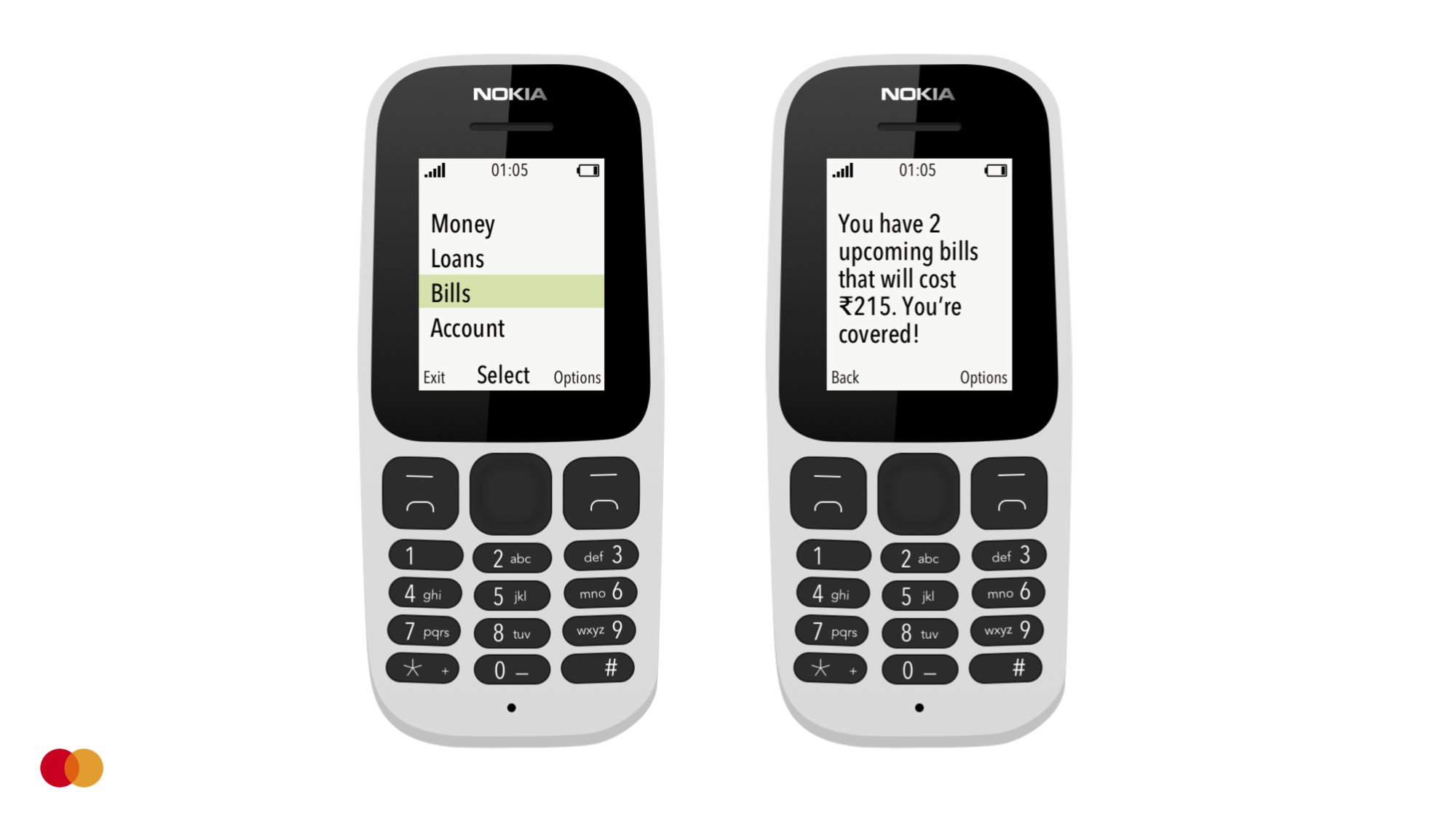

Feature phone interface

Feature phones with only basic capabilities are used most often in Africa. Mastercard has partnerships with companies and mobile networking operators like M-Pesa and Vodafone that will allow us to leverage money sending through SMS and track the user's spending data to generate a trust score for them. The user can access their Mobile trust app where they can see their balance, loan matches, bills, and other account info in a simple text UI.

Smart phone interface

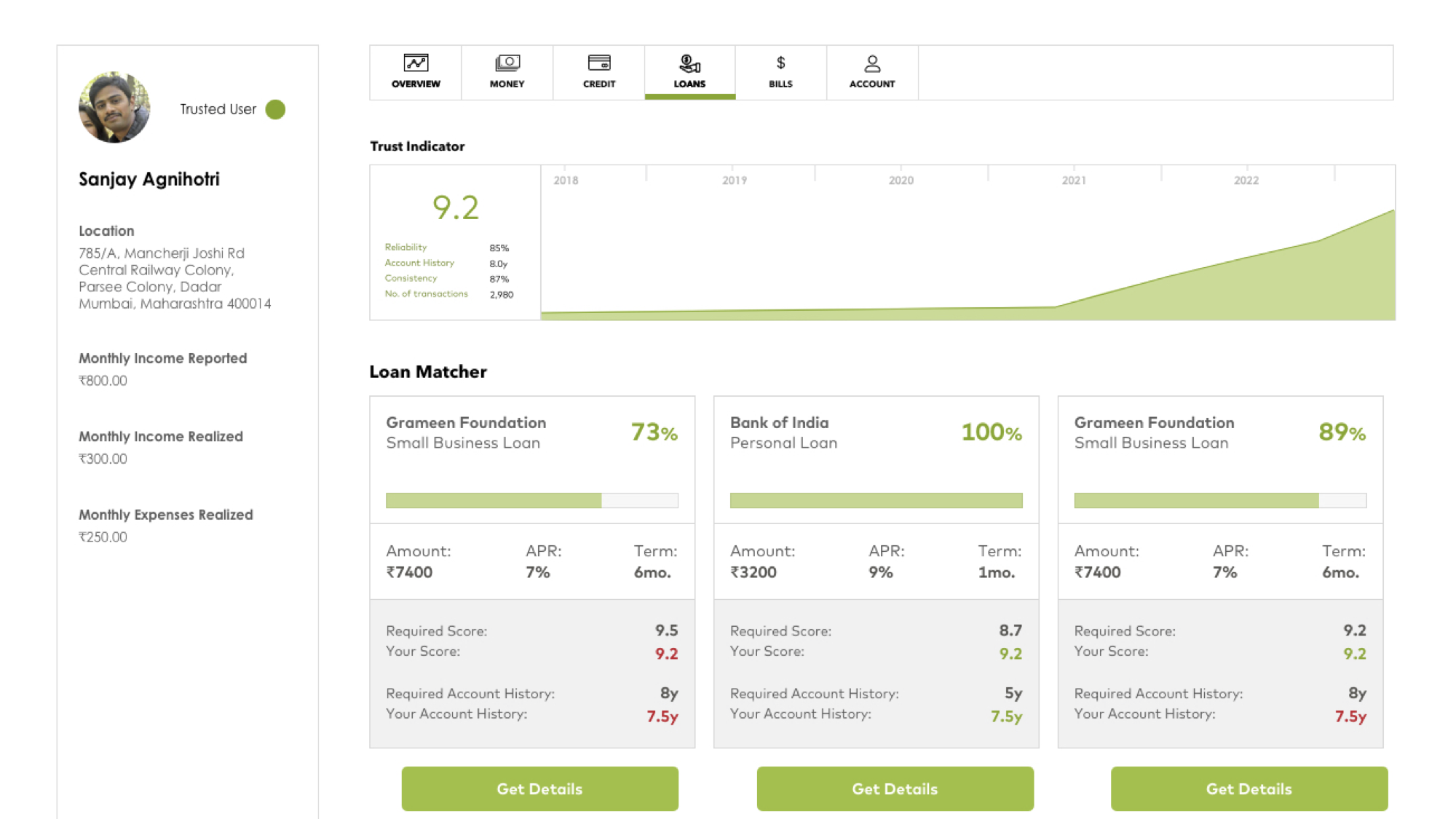

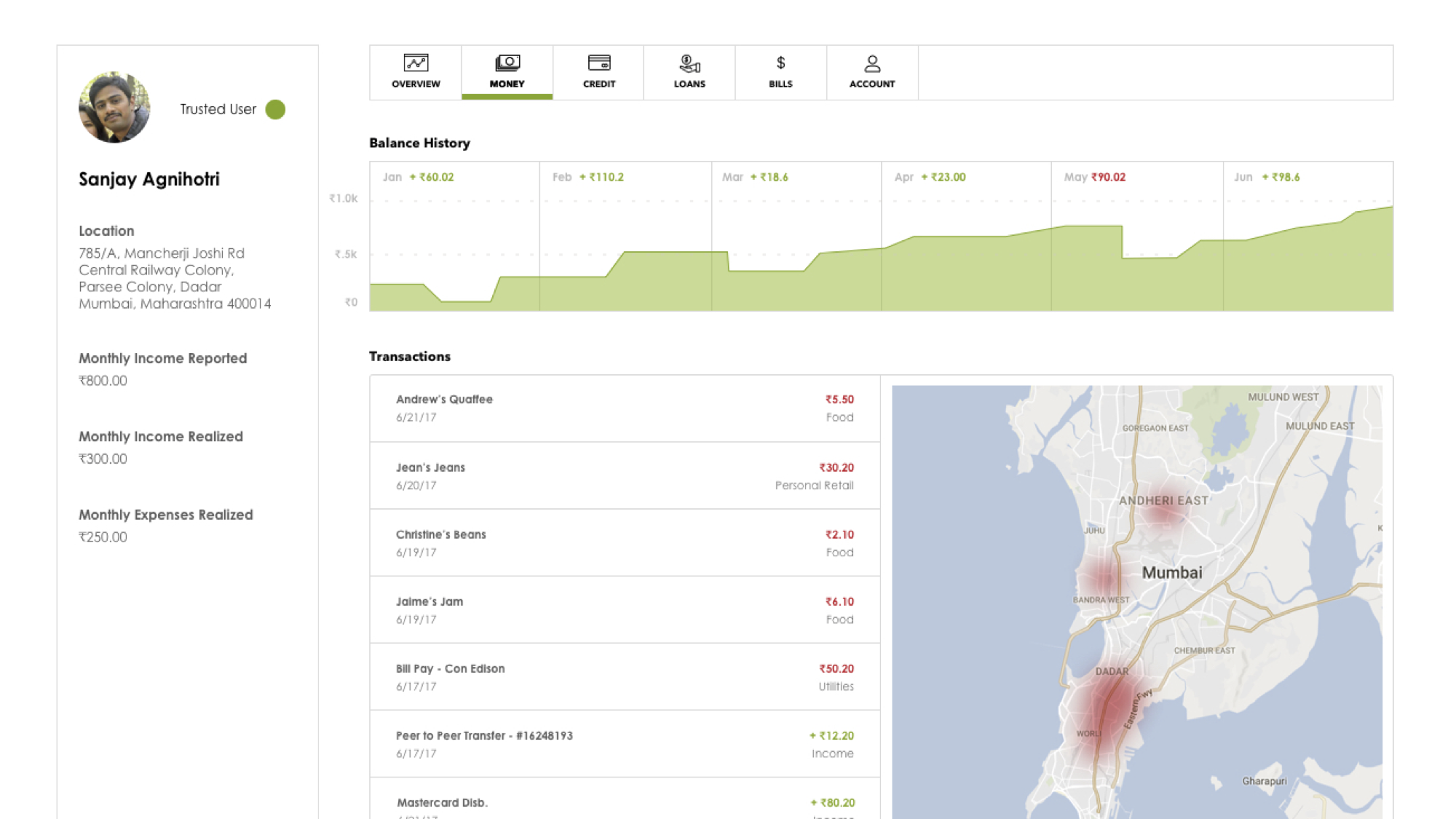

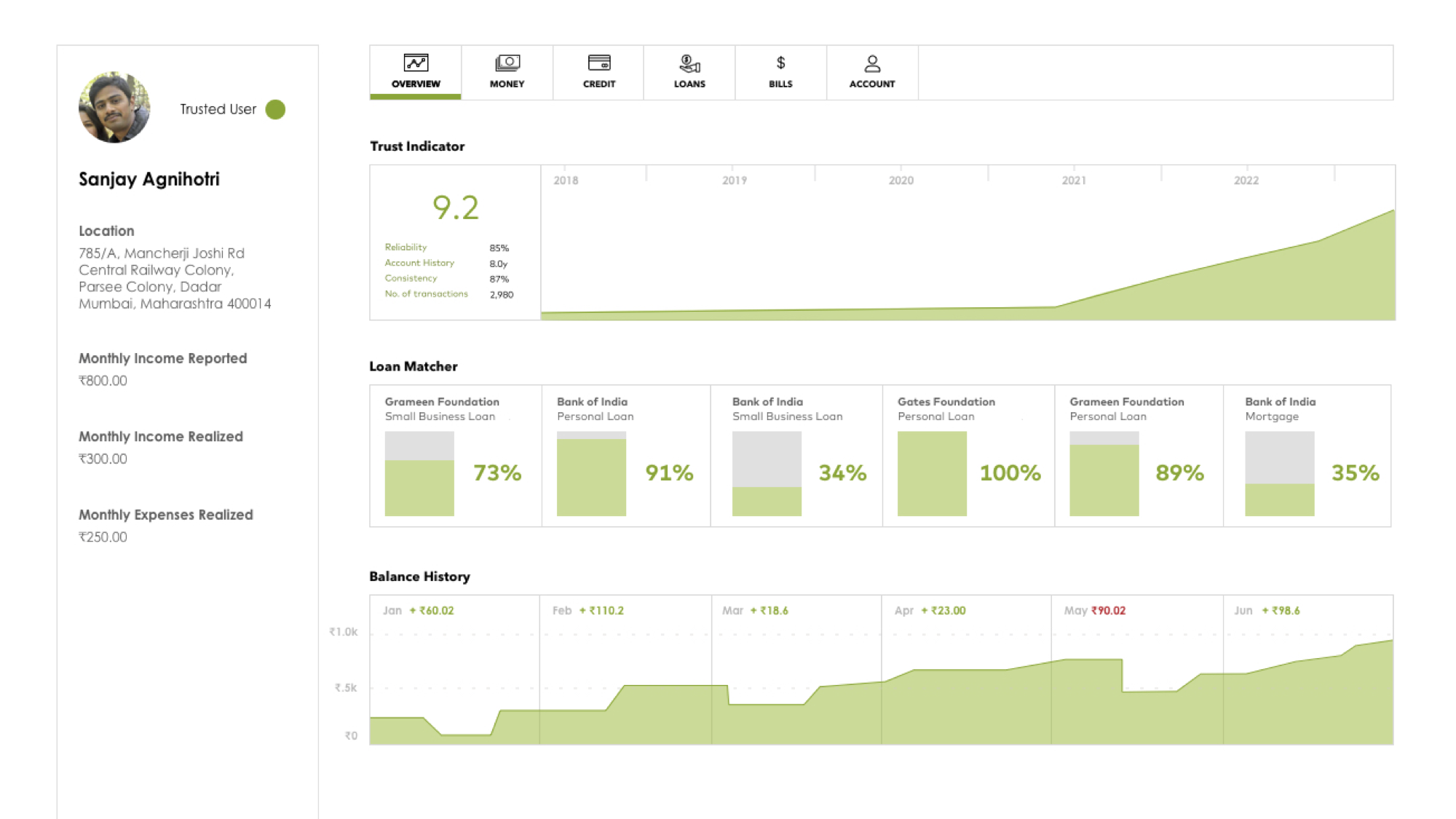

We created a more robust interface for smartphone users where the user can track their spending and trust score. Countries like India have a big underbanked population however are very technologically advanced so smartphones are more commonly used. With the capabilities of smartphones we can display different graph visuals so it is easier for the user to track their progress. Maps showing the geolocation of where their transactions took place can be shown and different loan matching options with details are shown too.

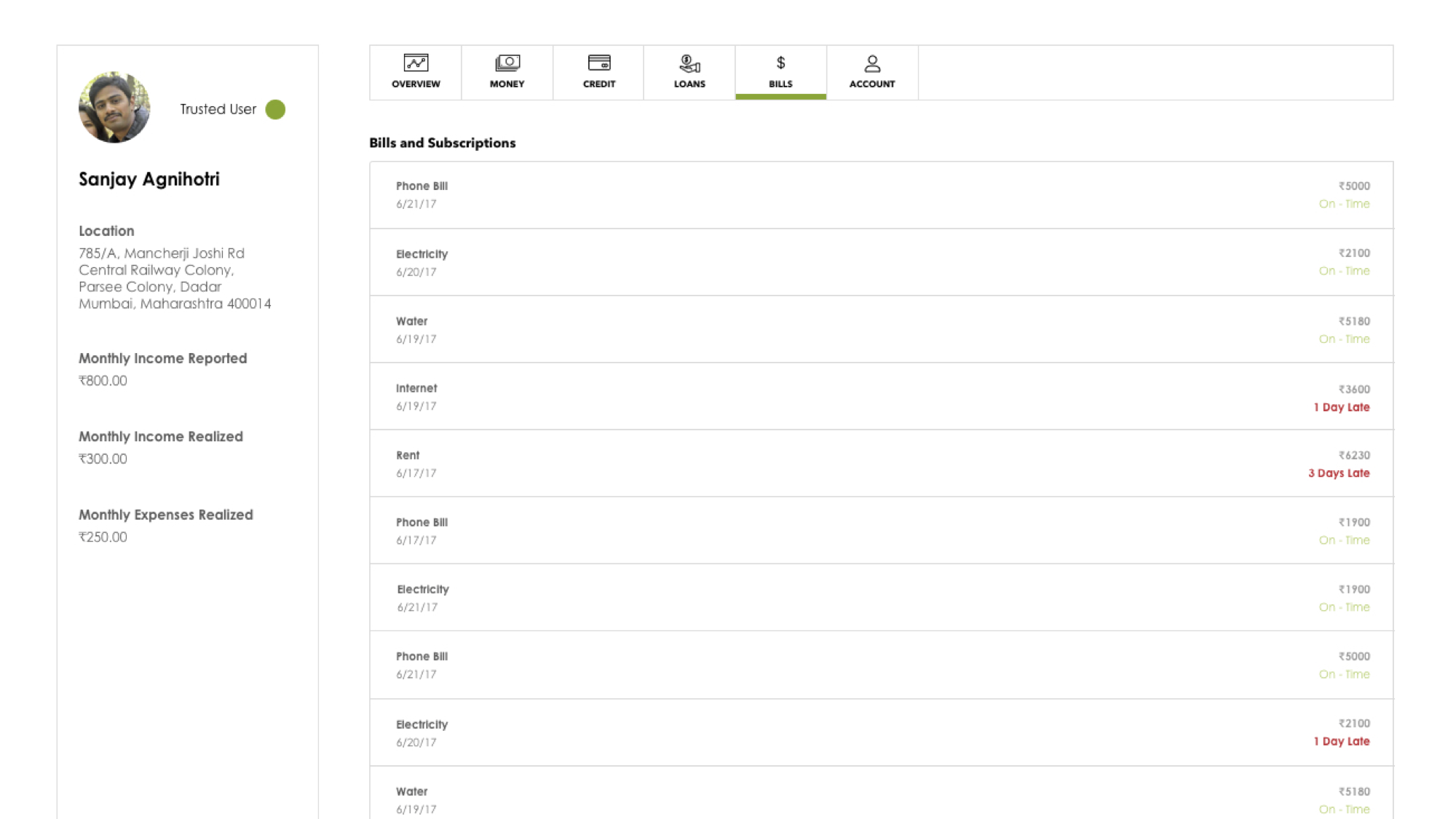

Web interface

This is the desktop view is of Sanjay's Mobile Trust account. The desktop view is seen my the mobile network operator who can provide Sanjay with the different loan options. In the case where Sanjay only has a feature phone and he wants to know more information about certain loans available to him, he is able to call his MNO and they can access his account with more details. The loans that are shown to Sanjay are NGO loans available to Sanjay based on his Mobile Trust score. Since loan acceptance processes can be unpredictable at times, a probability breakdown is displayed so that Sanjay can expect what his chances for getting the loan will be.

Business Solution

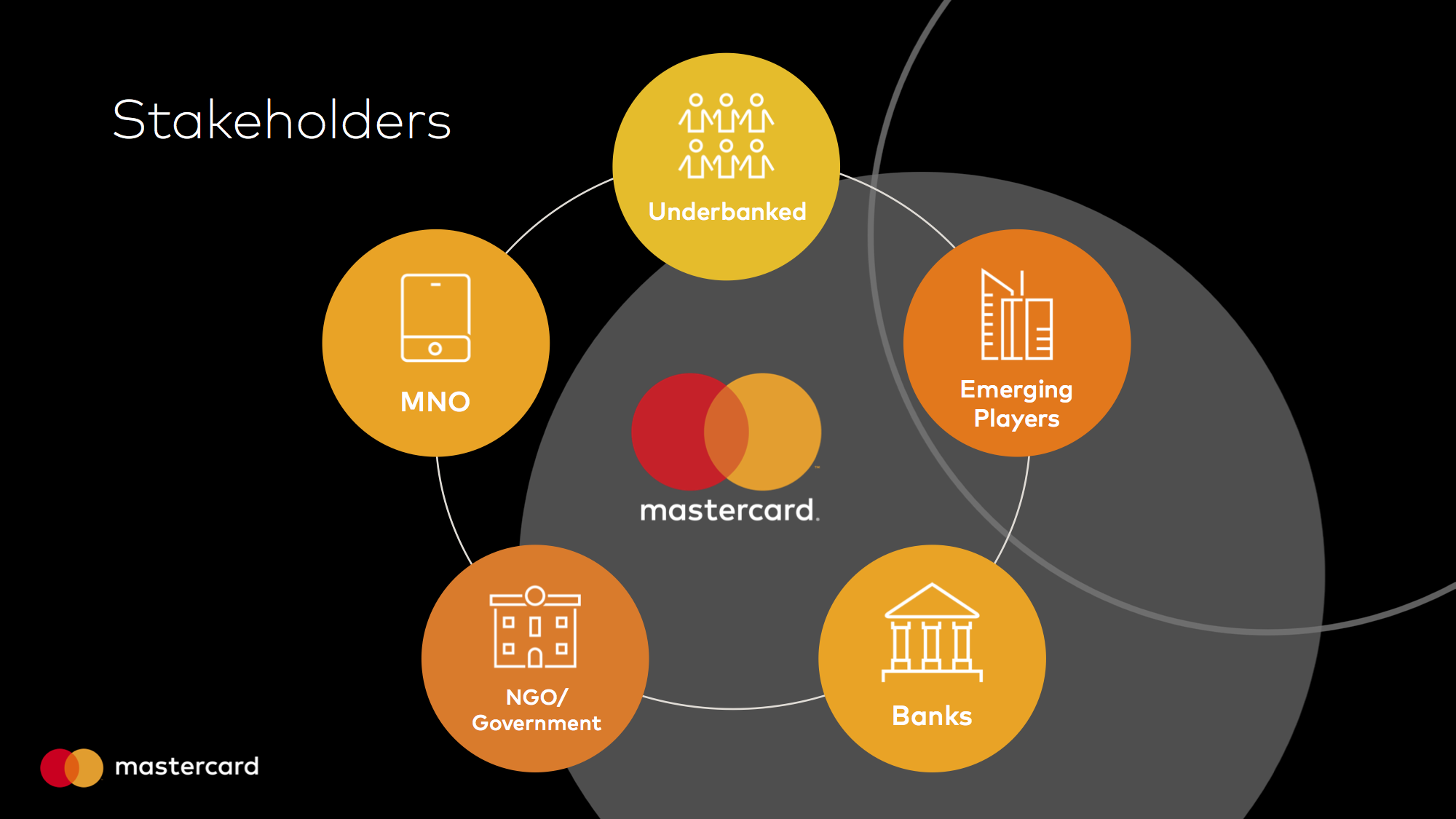

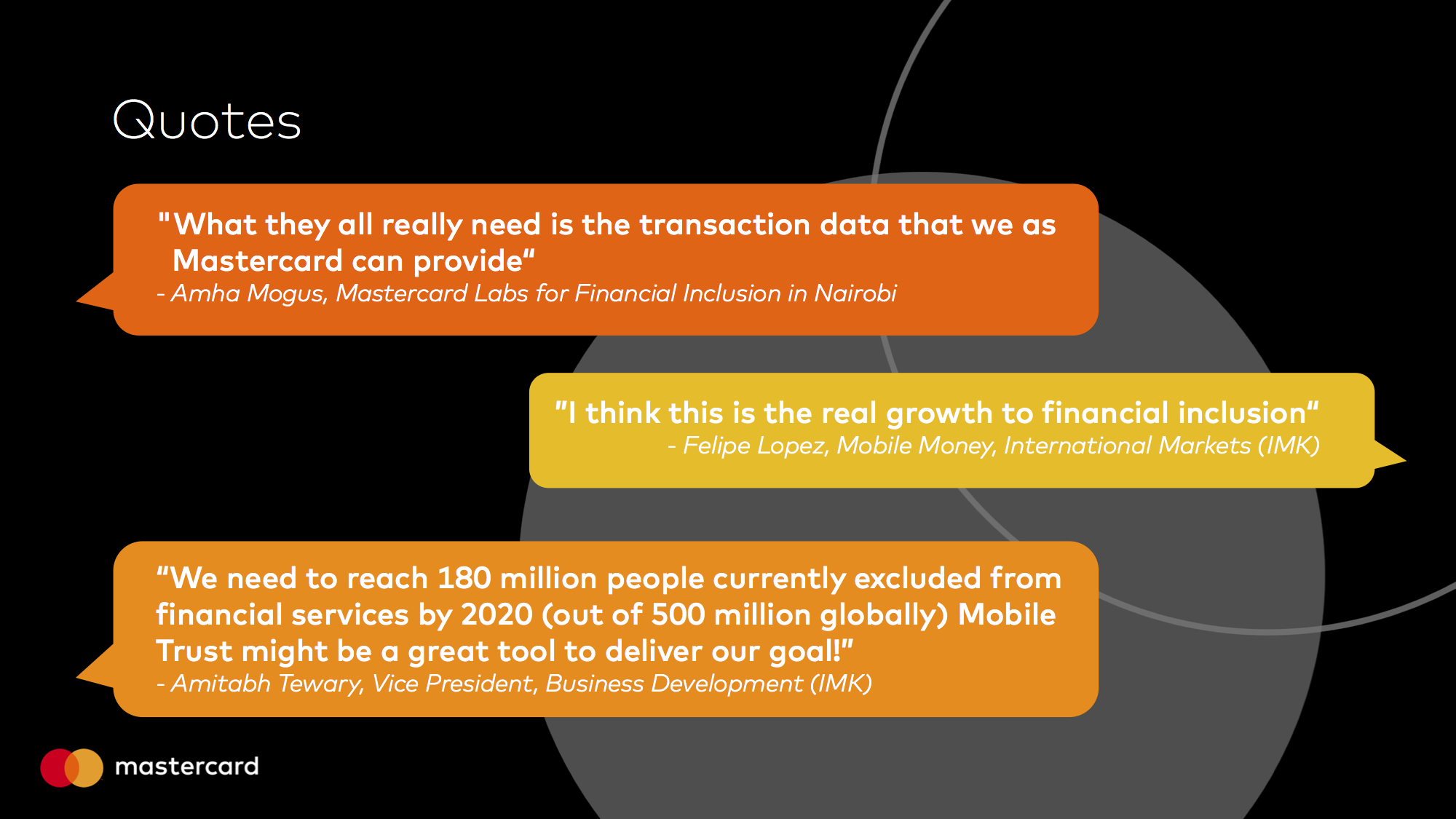

There are many different stakeholders that would be a part of this solution, making Mastercard the ideal candidate in this space, with the strong relationships we have with these entities. Through internal research and validation from various teams within Mastercard, it is clear that this is a product that the underbanked population needs and Mastercard can provide.

Learnings

Within the 30 hours that this project was conceived in, we learned a lot about the underbanked population and various other money loan cultures outside of the US. Mastercard being a global company and having a strong presence in many other parts of the world, it was a chance for us to reach out to other parts of the company in order to gain better insight in how our offerings differ. It was very exciting to learn about money loan cultures in other countries as well as consider designs for environments without as advanced technological infrastructure as what we take for granted.